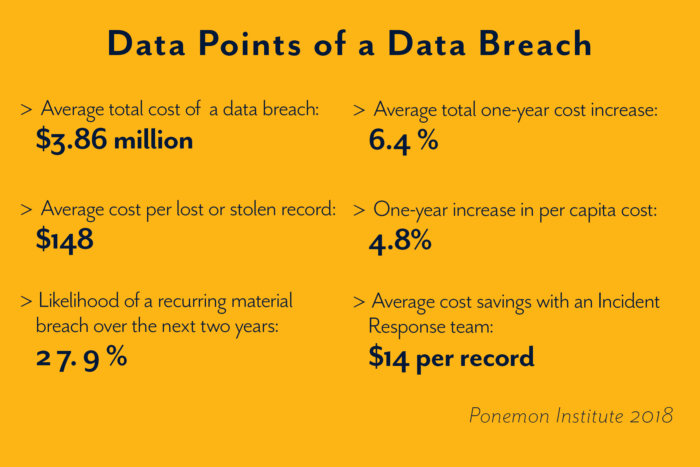

Cyber Risk insurance is vital to the financial well-being and future of your business. A single claim can be expensive and challenging to overcome on your own, but Cyber Risk helps reduce that claim’s potentially disastrous effects.

Technology, social media marketing, and online transactions play vital roles in how most companies conduct business and reach out to potential customers, which has created various openings to cyberattacks. No matter where they originate, cyberattacks are bound to happen, causing moderate to severe losses.

A Cyber Risk insurance policy, also known as Cyber Insurance or Cyber Liability Insurance Coverage (CLIC), is designed to help a business reduce risk exposure by offsetting the costs involved with recovery after a cyber-related security breach or similar event.

You should consider Cyber Risk insurance if you are a:

Any company—whether online or brick & mortar—that accepts and processes credit card payment information should have a cyber risk policy in place.

From realtors and contractors to accountants and lawyers, if you store or process sensitive information like names, addresses, or Social Security numbers, you need cyber risk insurance.

Any company that stores non-public, private information—belonging to either employees or clients—on a network, including financial firms, banks, insurance agents, mortgage brokers, medical offices, pharmaceutical companies, healthcare service providers, and manufacturers.

First-party Coverage

This covers damages you and your business suffer because of a data breach.

Third-party Coverage

This covers damages if customers or partners are affected by a cyber-attack on your business.

Cyber Risk insurance is vital to the financial well-being and future of your business. A single claim can be expensive and challenging to overcome on your own, but Cyber Risk helps reduce that claim’s potentially disastrous effects.