Trends in funding arrangements for 2021 continue to change. This is because the way employers pay for healthcare is based on a desire to reduce costs. The standard fully insured market is the default employer model, but fewer companies are sticking with the default. Kaiser Family Foundation or KFF produces a report each year that covers funding mechanisms. They report on the number of employees covered under different types of funding.

In the report, they point out that healthcare is complicated and some of the numbers are questionable based on people not understanding the question asked and potentially giving an incorrect answer.

Benefits Funding: Self-Funded Medical Plan

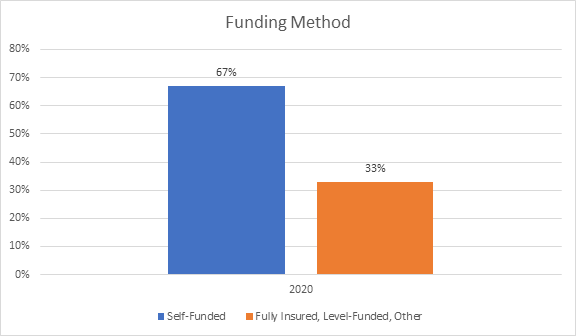

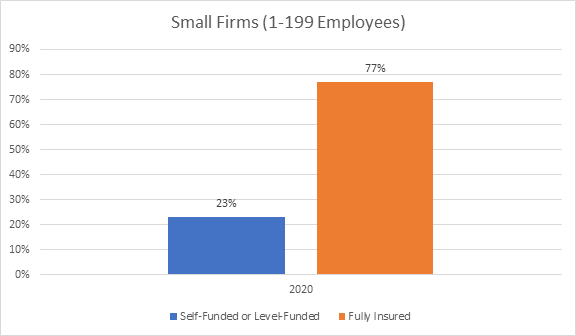

Most employees are covered by a self-funded medical plan. This doesn’t mean most companies self-fund, because the largest companies’ almost always self-fund. This is an increase from 61% from 2019. When a group self-funds the medical plan the company pays for all of the medical claims and uses an insurance company to administer the claims.

Self-Funding Can Save Money

Self-funding the medical plan can save company money. This happens in two ways, first, there isn’t another company taking their cut of the dollars spend in healthcare. Or another way of thinking about is one of the middlemen in the healthcare value chain is removed. The second way that a company saves money is that they only pay the claims that are incurred by their members. When members use less healthcare the company pays less and is able to save money.

Benefits Funding: Level-Funded Plan

There is a middle step between fully insured and self-funding, and that is level-funding the medical plan. This behaves very similarly to fully insured. An employer group pays a monthly bill to an insurance company. Then at the end of the year, if the employer group had fewer claims than expected the insurance company gives money back to the employer group.

Benefits of Level-Funded Plan

There are some benefits to a level-funded medical plan. The employer group can easily budget the monthly expense and avoid the swing of paying for every claim when it happens. The employer group is also able to share in potential upside. Getting money back at the end of the year is a nice experience.

Benefits Funding: Fully Insured Plan

Trends in benefits funding are changing, but most people think of using the fully insured model. Using the fully insured model means an employer group pays an insurance company a monthly bill for coverage. The insurance company manages all aspects of the care for the employees of the company. There isn’t much upside for an employer group to stay fully insured, but many do for a multitude of reasons. The main reason being that is simple and easy.

Alternative Models for Funding

There are a few other methods that are small and still getting worked out. There is Referenced Based Pricing or RBP, and Direct Contracting. Both models are a form of self-funding the medical plan.

Reference Based Pricing

In RBP an employer group pays for medical services by providers based on a percentage of what Medicare pays. Typically, an employer will pay the provider less money than the provider is expecting to receive, and there are often troubles associated with this method. RBP can save employer groups lots of money but there can be extra problems.

Direct Contracting

Direct Contracting is when an employer will contract directly with a provider for service. This is a great alternative to working with a standard network because employer groups are often able to get better rates. The biggest downside and the reason it still isn’t widely used is the difficulty in getting enough providers contracted to create a network. According to KFF, there are over 1 million doctors in the United States, and that doesn’t include hospitals or other facilities.

Trends in Benefits funding for 2021 are constantly changing and evolving. Diversified Insurance Group is qualified to help you navigate the Benefits funding world and find the best fit for your company. You can contact us here.